The Condition Monitoring Market is Set to Boom by 2025

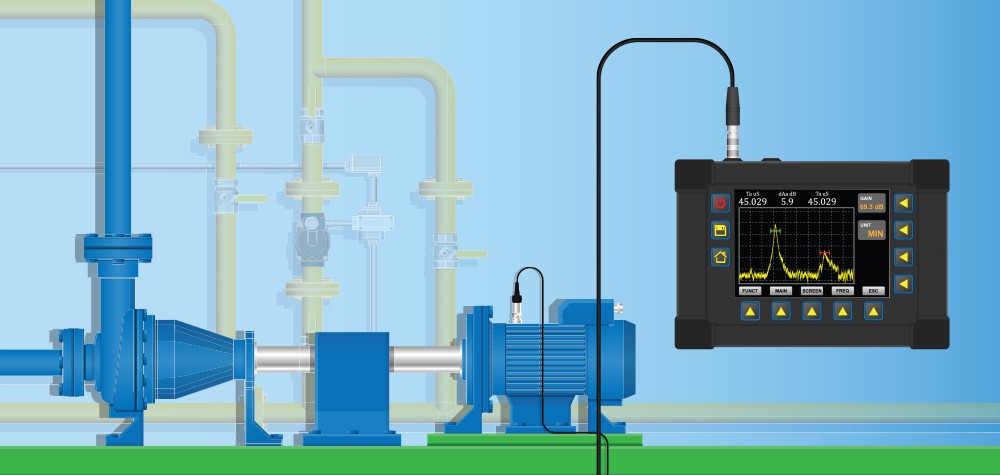

Of the many rising technologies heralding Industry 4.0, condition monitoring leads the charge. Condition monitoring sets the tone for practices like predictive maintenance and leaner repair procedures. It stands to be the single biggest driver of industrial innovation — and the numbers prove it. According to a new report from Research and Markets, condition monitoring is in for booming times ahead.

The report, which measures anticipated growth in the predictive maintenance market, specifically condition monitoring, predicts a compound annual growth rate (CAGR) of 7% by 2025. Condition monitoring is expected to become a $3.9 billion market, growing more than $1 billion from its current valuation. What’s driving this explosive growth? All signs point to the continued digitization of factories and the growing demand for leaner, smarter maintenance strategies.

As factories ease into the Industrial Internet of Things (IIoT) and embrace smart devices, condition monitoring equipment will act as a natural bridge into Industry 4.0. Manufacturers can invest incrementally in sensors and condition monitoring equipment, building out their digital infrastructure to scale as they become more familiar with expanding digital operations.

Condition monitoring has such broad potential for growth because it’s nearly universal across different sectors of industry. In the same way oil and gas refineries may leverage real-time microbial analysis into operations, metallurgical operations have a need for real-time comparative quantitative thermography equipment. Condition monitoring solutions already exist for nearly every facet of manufacturing:

Tribology

Tribology- Vibration analysis

- Motor circuit analysis

- Thermography

- Ultrasonic monitoring

- Radiography

- Interferometry

- Electrical

- Electromagnetic measurement

The broad-spectrum solutions addressed by condition monitoring make it easy for any manufacturer to buy into a predictive maintenance strategy. For a relatively minor investment, manufacturers can experiment with condition monitoring solutions and begin to familiarize their technicians with proactive maintenance strategies.

Despite the relative ease of entry — especially with growing original equipment manufacturer (OEM) competition in the sensor and device market — there are still headwinds in front of condition monitoring. Lean-running factories with tried and true cyclical maintenance strategies may not see the return on investment (ROI) to justify an investment in condition monitoring at this stage.

In addition, many manufacturers simply aren’t sure how to measure the ROI of condition maintenance or a predictive maintenance strategy. Is ROI measured in a pure cost of maintenance reduction? Lower failure rate? Reduction in downtime? Increased production? All of the above? Without understanding the ROI, many are hesitant to make the investment.

Building out a digital ecosystem is a challenge as well. In addition to choosing the right equipment and software support systems, factories also need to consider cybersecurity costs, training costs, transition costs, and other inherent expenses not included in the upfront investment.

The rise of condition monitoring and the subsequent shift to predictive maintenance are inevitable. The next five years promise to be a landmark shift in maintenance operations for many manufacturers, as the barriers to a condition-based maintenance solution begin to dissolve. From there, maintenance is certain to change forever, for the better.