Layoffs are Still Climbing; Manufacturing Could Help Bring Them Down

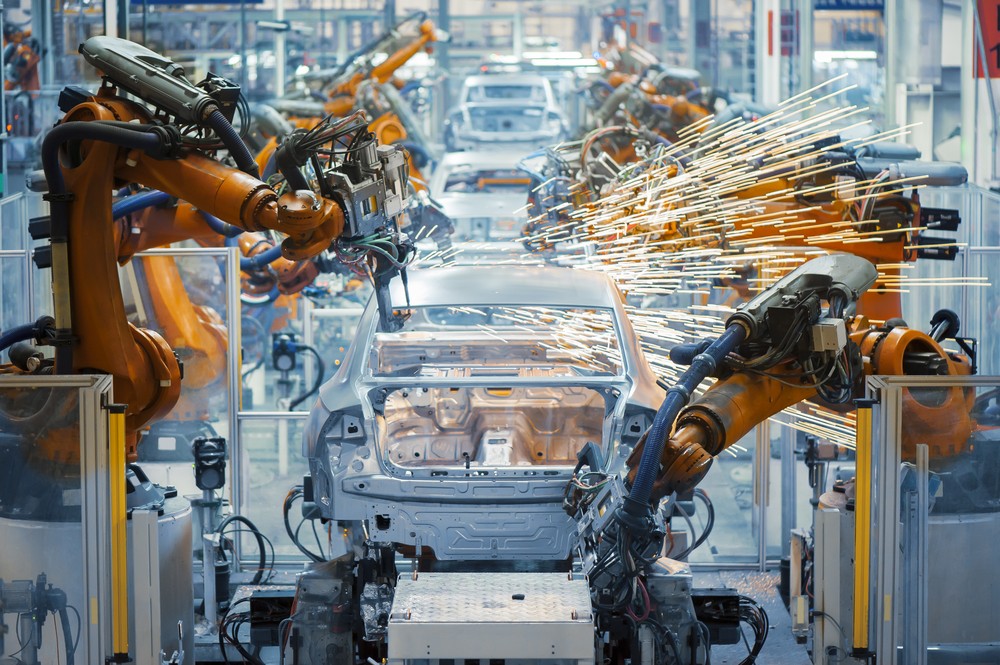

As it so often is, the manufacturing economy is typically looked at through the lens of automotive manufacturers. Over the past few weeks, these pillars of U.S. manufacturing have begun welcoming back workers, signaling recovery after widespread COVID-19 shutdowns. But is this indicative of the broader manufacturing sector? Layoffs are still on the rise and unemployment continues to increase week over week. Is news from the automotive industry representative of domestic manufacturing as a whole? If it is, are we on the upswing?

The answer to unemployment and its near-term prospects is complicated. In one sense, yes, automakers represent a significant portion of U.S. manufacturing. Domestic automakers represent about 3.5% of the United States’ total GDP and contribute to as much as 11% of total GDP through their impact on the broader manufacturing economy. To say that automotive manufacturing is still largely representative of total manufacturing is reasonable. And, because that’s the case, there’s reason to be optimistic about the unemployment rate in the near term.

Automakers were one of the first sectors of the manufacturing economy to furlough and lay off workers. Now, those workers are coming back in droves. General Motors recently announced the return of most of its 48,000 hourly workers. Ford’s workforce of 12,000 is nearly completely back as of May 18, with many administrative jobs converted to telecommuting positions. With more fanfare than its traditional counterparts, even Tesla has resumed operations.

As automotive manufacturing employees flood back to work, unemployment filings have continued to climb — up to 41 million as of the end of May. Will those figures stop or drop thanks to the resurgence of the automotive industry? Some analysts believe we’re headed higher; however, others see a clear path to lower employment as automotive manufacturers set precedent.

With automakers leading the way, it’s likely more manufacturers will begin prioritizing a return to work. Moreover, many producers are scrambling to ramp back into full capacity for reasons driven by competition. Consumer demand is rising again, according to electronics manufacturers. Overseas, companies like LG have been hit with a surge in demand for consumer products like Apple’s iPad, requiring them to scale quickly back up to operational capacity. This trend is likely to emerge in other sectors of consumer goods and durable goods production — opening the door for reemployment from domestic manufacturers.

Those producers following the automakers also see the opportunity to grab market share. If demand does rise or remains unfilled, agile manufacturers who can get themselves up and running again are poised to win in their respective sectors. It won’t be long until reemployment isn’t just a priority — it’s a race.

Manufacturing has been battered throughout COVID-19. Even those producers who remained open and operational have faced issues with demand on one side and supply chain on the other. As quick as these problems arrived, they could be gone. As employees return to work, the U.S. jobless rate will fall, and the manufacturing sector may attract a new crop of workers who want to move from the unemployed column to a steady paycheck in an industry that continues to represent a crucial pillar of the American economy.