December Regional Manufacturing Numbers: What Do They Mean for 2018?

By taking a look at what’s happening in the 12 U.S. Federal Reserve Regional Districts’ manufacturing sectors, you can get a good idea about the state of the industry nationwide. Analysts use this regional information, with some regions reporting on a monthly basis, to form accurate insights and chart progress for the sector.

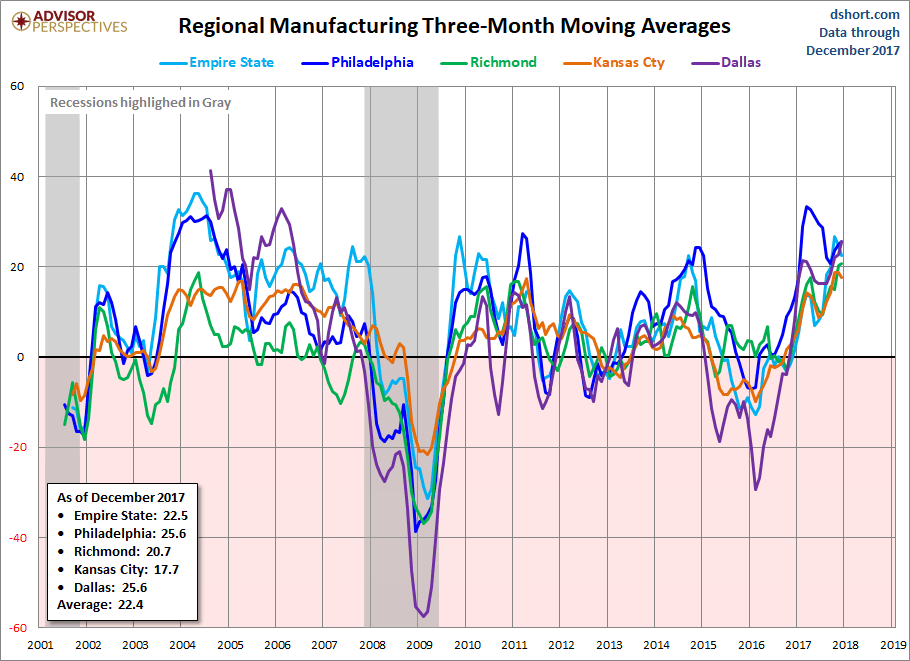

In December, expansion and contraction data within the five districts shows each area experiencing the same rise or drop overall. With manufacturing jobs making up 12% of the U.S. gross domestic product (GDP), this information can help predict both positive outcomes and any potential problems on the horizon.

Regional average highest in 13 years

Last month’s regional reports reflect numbers at an all-time high. This is an indication of strong growth and continued flourishing economic health in the manufacturing sector. Here’s what is happening in the five districts:

- Dallas — Texas is a key player in the manufacturing industry. It ranks first among the states for exported manufactured goods and second — behind California — in factory production. Analysts use specific business indicators — such as production, new orders, employment, and materials inventories — to determine trends, and Dallas indicators were increasing in every area except one. Production alone went from 15.1 in November 2017 to 32.8 in December. This nearly 18-point increase, according to the Advisor Perspectives article, is the highest it’s been in 11 years and one of the strongest determinants of economic health within a state. Manufacturing business trends look excellent in Dallas with hiring and wage increases on the rise as well.

- Kansas City, Missouri — This district represents several states, including Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri, and northern New Mexico. Like Dallas, the Kansas City outlook is bright and optimistic. While the 10th District did experience some minor decreases in areas such as shipments and new orders, the region’s production numbers rose from 15 to 21. Weather affected certain businesses, and the region improved much more slowly than Dallas, but company leaders reflected a solid year overall. Kansas manufacturers, therefore, anticipate a strong manufacturing year in 2018.

- New York — The Empire State District was steady in December with an optimistic outlook. The general business condition index remained stable but areas such as shipments and new orders saw notable growth. While the Empire State District doesn’t reflect as many increased business indicators as some other districts, its economic health outlook is still strong with capital spending plans on the upswing. Company leaders and analysts predict a solid manufacturing year.

- Richmond, Virginia — The 5th District started out strong with a composite manufacturing index of 20. While it’s down from November’s all-time high of 30, it shows ongoing growth. Richmond data shows slight drops in some areas, but not enough to impact the encouraging overview. Plus, the employment indicator increased, showing improved economic health and a positive outlook. Expectation indicators also increased, and manufacturing companies are looking forward to a good year in the 5th District.

- Philadelphia — The 3rd District, which “covers eastern Pennsylvania, southern New Jersey, and Delaware,” is also looking forward to solid growth in 2018. Although the general activity index dropped from 27.9 in November to 22.2 in December, it “has been positive for twenty consecutive months,” and new orders and shipments indicators showed increases. Employment was up, and manufacturing leaders expect wage increases this year. Other numbers remained steady, and the outlook was still good — even in areas with decreases. Philly manufacturers, like those in other regions, are optimistic about the 2018 manufacturing year.

An optimistic outlook

Optimism seems to be the thread uniting each of these manufacturing districts. Overall activity and production indicators have risen in all five sectors, and employment and future wage increases are other common indicators of good economic health. Even where numbers decreased there was, surprisingly enough, still growth and improvement with each locale reflecting a positive outlook for 2018. A busy, productive year seems highly likely in these regions which, if statistics hold true, means the same for the nation.

Check back soon for our January regional manufacturing update!