2020 Was Hard on Next-Gen Transportation Manufacturers

The 2020s were poised to be the decade of next-gen transportation. Manufacturers and consumers were primed for a new breed of electric vehicles and the return of supersonic jets. But pandemic hardships altered the outlook in ways we’re just beginning to understand. Late in the second quarter of 2021, manufacturers went public with their struggle; key drivers of next-gen transportation are faltering. What does all this mean for the future of transportation technology?

Lordstown Motors sends up a smoke signal

Once one of the most promising electric vehicle manufacturing startups, Lordstown Motors is now suffering from a lack of funds. The company has $587 million on hand, but that won’t be enough to commercially produce its highly-anticipated electric pickup truck — ironically dubbed the Endurance. Lordstown experienced a net loss of $125 million in the first quarter of 2021, and CEO Steve Burns predicts the company will lose as much as $380 million this year. Shares of Lordstown Motors dropped 16.2% earlier this month.

Lordstown is trying to alleviate its financial troubles by seeking loans from partners, financial institutions, and the government. If it cannot secure additional funding, the company is only expected to produce around a thousand electric vehicles this year — tarnishing its once-bright future and falling far short of the numbers necessary for generating positive cash flow.

Aerion has already disappeared from the landscape

While Lordstown Motors is struggling to survive, Aerion Supersonic has officially thrown in the towel. The company’s AS2 silent jet was set to be the first commercial supersonic aircraft to take to the skies since the Concorde was retired in 2003. Aerion’s promising rise was backed by Boeing and featured an exclusive partnership with GE Aviation to produce its next-gen Affinity jet engine. But lacking the necessary funds to finish its AS2 jet, Aerion announced an immediate cessation of operations late last month.

Aerion’s departure from the industry is a major setback for the future of commercial supersonic travel. Without a clear frontrunner, the burden of next-gen air travel falls to a group of fledgling companies with technology less advanced than Aerion’s — and even less funding.

Even established companies are suffering

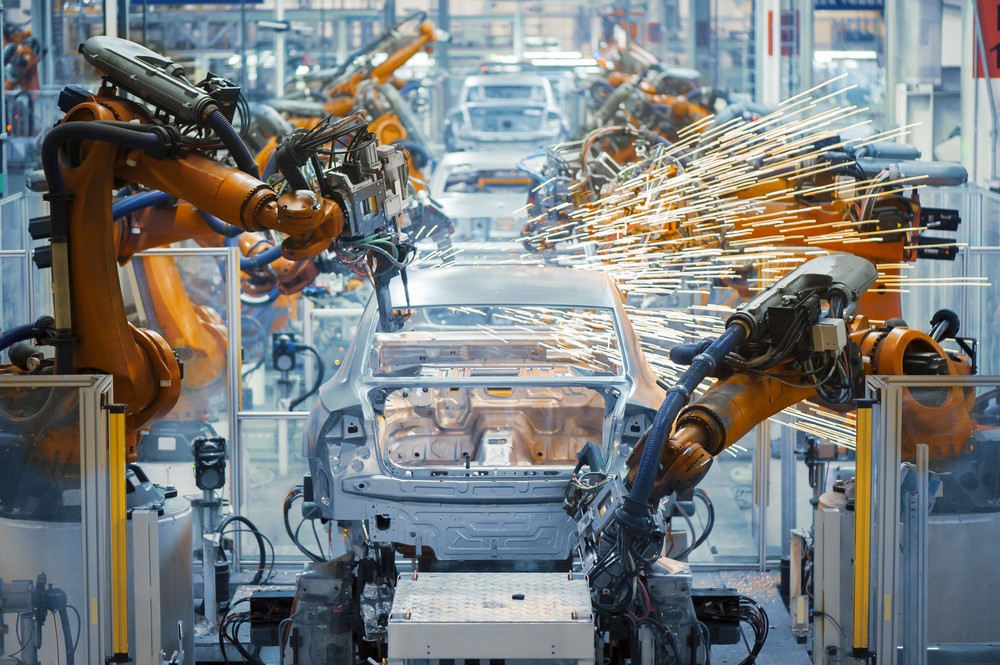

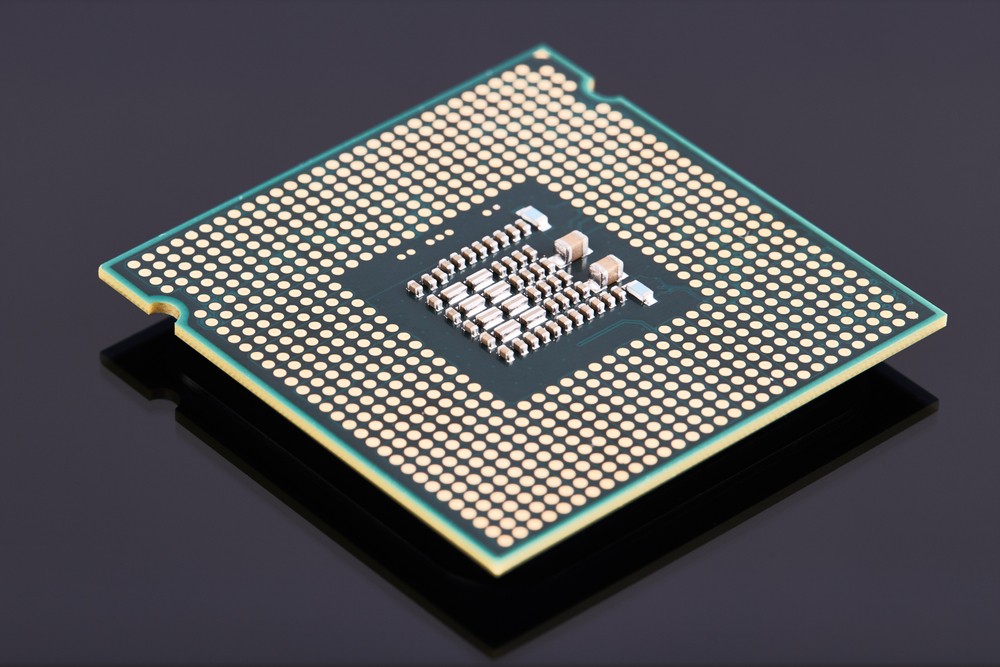

Next-gen manufacturers aren’t the only ones afflicted. The current semiconductor shortage has stalled production for the auto industry — traditionally more resilient than other manufacturing sectors in the United States. Without semiconductor chips, automakers are unable to complete production, resulting in a formidable backlog of unfinished vehicles.

It’s a testament to the disruptive power of the pandemic when even established automakers like Ford and General Motors continue to face materials shortages and feeble supply chains. But companies with established balance sheets can weather the storm while their startup counterparts flail for purchase.

Making up lost ground in the decade to come

The future of next-gen transportation looks grim, but there is hope. Boom Supersonic is picking up where Aerion left off; its supersonic jet — the Boom Overture — is currently in development. In the electric vehicle manufacturing industry, companies like Rivian and Nikola Corporation are showing promise. For surviving companies, it’s a “next man up” scenario — proving there is room for growth in the next-gen transportation manufacturing industry — despite the current disruption.